Form 990 and Meeting Minutes: What You Must Know

For tax-exempt organizations, board meeting minutes are directly connected to Form 990 preparation. Understanding these requirements is critical for maintaining your nonprofit's tax-exempt status.

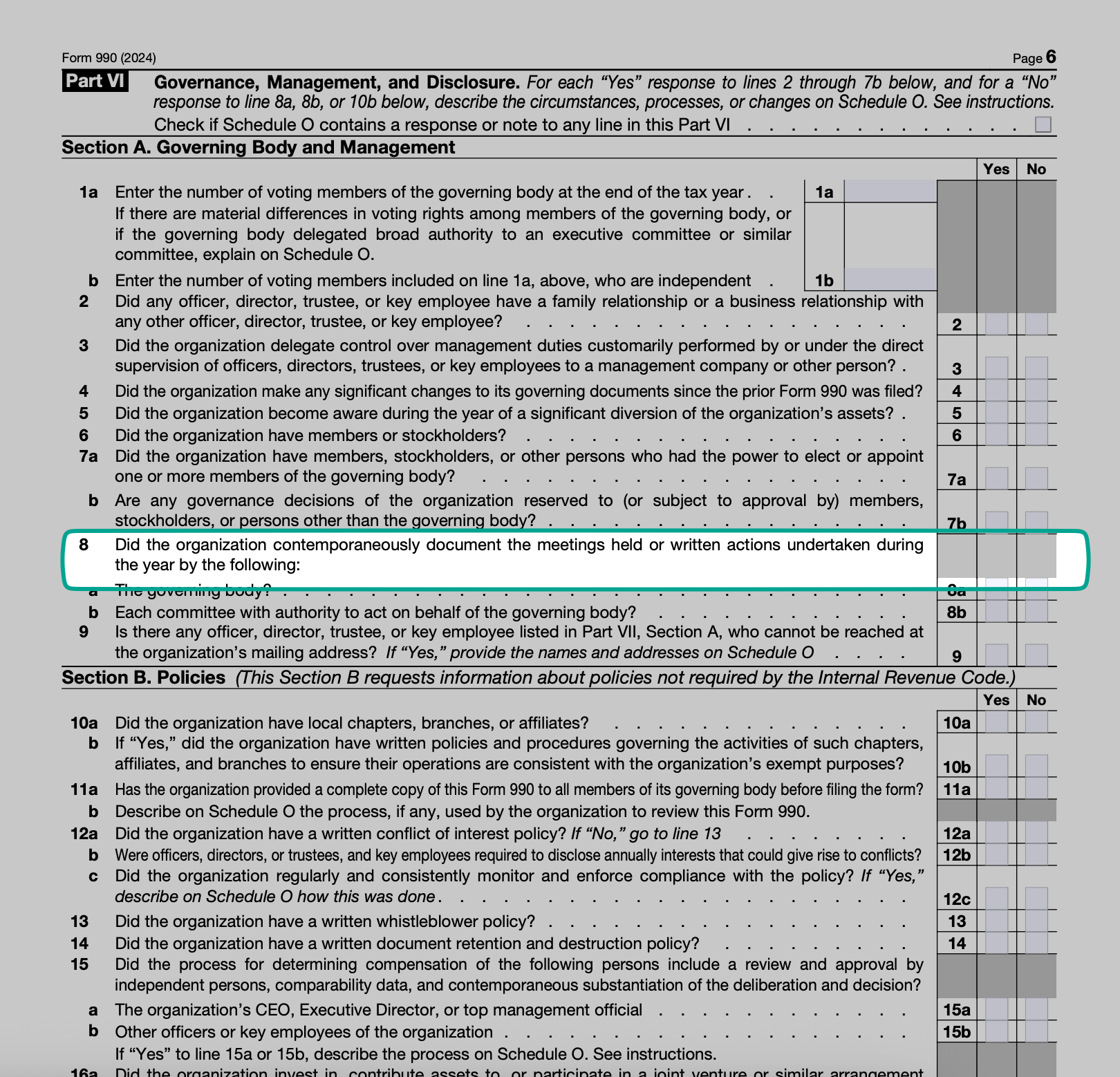

IRS Part VI Requirements

Here's what you need to know: You do NOT submit meeting minutes with your Form 990 filing. Instead, the IRS asks a simple yes/no question in Part VI: Does your organization maintain contemporaneous documentation of board meetings? This documentation must exist to support the governance and financial decisions you report throughout the form. Answering "no" to this question raises immediate red flags with the IRS, potential donors reviewing your public 990, and grant-making foundations.

Contemporaneous Documentation Standard

The IRS has specific timing requirements for when meeting minutes must be created. "Contemporaneous" means your minutes must be completed within 60 days after the meeting or by the next meeting of the governing body, whichever comes later. This timing requirement isn't arbitrary—it proves your board operates according to your bylaws, fulfills its fiduciary duties, and makes decisions in a reasonable, well-documented manner. Minutes created months after a meeting raise questions about their accuracy and whether the board is truly governing the organization.

What to Document for Form 990

Every set of meeting minutes should start with the basics: your organization's name, the date, time, and location of the meeting, who was present and absent, and confirmation that a quorum was achieved. Without these fundamentals, your minutes lack the authority needed for IRS compliance.

When documenting decisions, record the exact wording of all motions, the outcome of every vote, and who made and seconded each motion. Include a brief description of what the action accomplishes. This level of detail proves your board is actively making governance decisions, not just rubber-stamping management proposals.

Executive compensation requires special attention for Form 990 reporting. Your minutes must document the specific terms of any compensation arrangements, what comparable salary data the board relied upon for approval, how that data was obtained, and the names of board members who were present for the discussion. The IRS scrutinizes executive compensation closely—thorough documentation protects both your organization and individual board members.

Conflicts of interest must be identified and managed transparently. When a potential conflict arises, document the transaction in question, note when interested board members recused themselves from discussion and voting, and record how the conflict was ultimately handled. This transparency demonstrates good governance and protects your tax-exempt status.

Finally, document that your board reviewed the Form 990 before filing. Record what questions or concerns were raised during the discussion and note the formal vote approving the return. Many nonprofits skip this step, but the IRS specifically asks about board review in Part VI.

Why Form 990 Compliance Matters

The stakes are high when it comes to meeting minutes and Form 990 compliance. Inadequate documentation can lead to failed IRS audits, jeopardize your tax-exempt status, and trigger excise taxes on transactions you can't properly document. Beyond the IRS, poor documentation erodes donor confidence—your Form 990 is a public document, and major donors and grant-makers review Part VI carefully before deciding whether to support your organization.

On the flip side, proper documentation delivers significant benefits. You'll pass IRS audits with confidence, protect your hard-earned tax-exempt status, and demonstrate to stakeholders that your organization practices good governance. Well-documented minutes build donor trust and provide legal protection for individual board members who are fulfilling their fiduciary duties. In short, the time invested in proper meeting documentation pays dividends in organizational stability and credibility.

Next Steps

What to Include in Minutes

Learn the essential components and proper level of detail for legally compliant meeting minutes.

Free Templates

Download ready-to-use templates that ensure Form 990 compliance.

Automate Your Form 990-Compliant Minutes

VideoToBe automatically captures all required details for Form 990 compliance, ensuring you never miss critical documentation.

← Back to Complete Guide